Here’s a full concept expansion of the Restoration Investment Trust—structured to show how it could operate as both a financial innovation and a regenerative community solution for the Genesee–Finger Lakes region.

? Restoration Investment Trust (RIT)

Concept Overview:

The Restoration Investment Trust (RIT) is a blended-finance mechanism designed to align community wealth-building with ecosystem regeneration. It treats natural systems—forests, wetlands, soils, and watersheds—as productive community assets that yield measurable ecological and social returns alongside modest financial ones.

Its purpose is to channel patient, values-aligned capital into bioregional restoration and resilience projects that conventional markets overlook.

1️⃣ Structure and Governance

- Legal Form: A nonprofit-owned public benefit trust or community investment cooperative that holds assets in perpetuity for the common good.

- Governance:

- Trustees represent local governments, land trusts, Indigenous stewards, cooperative enterprises, and citizen investors.

- Decision-making follows consent-based or sociocratic principles to ensure equity and transparency.

- Accountability: Open ledgers record both financial flows and ecological performance metrics (soil organic carbon, biodiversity, water retention, etc.).

2️⃣ Capital Stack and Instruments

The Trust blends multiple forms of capital:

- C-PACE financing for commercial and multifamily retrofits (energy, water, resilience improvements).

- Green bonds or community climate notes to fund restoration infrastructure (riparian buffers, agroforestry corridors, solar farms on degraded land).

- Philanthropic recoverable grants to de-risk early projects.

- Municipal or regional contributions (land, matching funds, revolving loans).

- Retail community investment shares, allowing local residents to co-own regional regeneration.

Returns are twofold:

- Financial: modest dividends from lease revenue, energy generation, ecosystem service markets, and property value uplift.

- Ecological/Social: quantified gains in habitat quality, water resilience, local employment, and climate adaptation capacity.

3️⃣ Portfolio Design

RIT manages a portfolio of place-based projects, balancing risk and impact:

- Urban: green roofs, stormwater gardens, building retrofits under C-PACE.

- Agricultural: regenerative farms with carbon-positive soil practices and agroforestry.

- Rural/Natural: wetland restoration, riparian corridors, reforestation, and pollinator habitat.

- Community: food hubs, repair cafés, circular-economy enterprises.

Each project contributes to a bioregional balance sheet—a ledger of ecosystem health and community wellbeing.

4️⃣ Measurement and Reporting

RIT employs open-source ecological accounting frameworks such as GLEAP (Global Ledger for Ecological and Anthropocentric Prosperity) or similar bioregional scorecards.

Metrics include:

- Carbon sequestered (tCO₂e)

- Soil organic matter (%)

- Biodiversity index

- Local jobs created

- Energy savings and resilience indices

- Community ownership ratio

Data is published on a transparent dashboard accessible to all investors and residents.

5️⃣ Regenerative Feedback Loop

Profits from mature projects flow back into a Reinvestment Pool that funds early-stage initiatives, education, and technical assistance. Over time, the RIT becomes self-perpetuating—a living endowment for the region’s ecological future.

6️⃣ Prototype Pathway for the Genesee–Finger Lakes Region

Phase 1: Seeding (Year 1–2)

- Establish founding partners: regional municipalities, NYSERDA, local land trusts, cooperative finance institutions.

- Pilot 3–5 demonstration sites: one urban retrofit, one farm-based agroforestry system, one wetland restoration.

- Issue a $10–20 million community green bond.

Phase 2: Scaling (Year 3–5)

- Develop a diversified project pipeline aligned with C-PACE financing.

- Launch a public portal for small-investor participation.

- Begin ecological dividend distributions.

Phase 3: Replication (Year 5+)

- Share the model with neighboring bioregions through a network of Restoration Investment Trusts, each adapted to local ecologies and economies.

7️⃣ Broader Significance

The Restoration Investment Trust bridges finance and stewardship, offering a replicable framework for funding regeneration without depending solely on philanthropy. It reframes investment as a collective act of care for place—turning the bioregion itself into the ultimate asset under management.

Would you like me to turn this into a two-page concept brief (suitable for funding partners or municipal collaborators), or a long-form essay or book chapter draft connecting it to your Possible Planet narrative?

Yes to 2-page concept brief:

Perfect — here’s a polished two-page concept brief for the Restoration Investment Trust (RIT), designed to be concise, visually scannable, and suitable for municipal partners, funders, or investors. I’ve formatted it in a way that could be directly adapted to a PDF or handout.

Restoration Investment Trust (RIT)

A Regenerative Finance Model for the Genesee–Finger Lakes Region

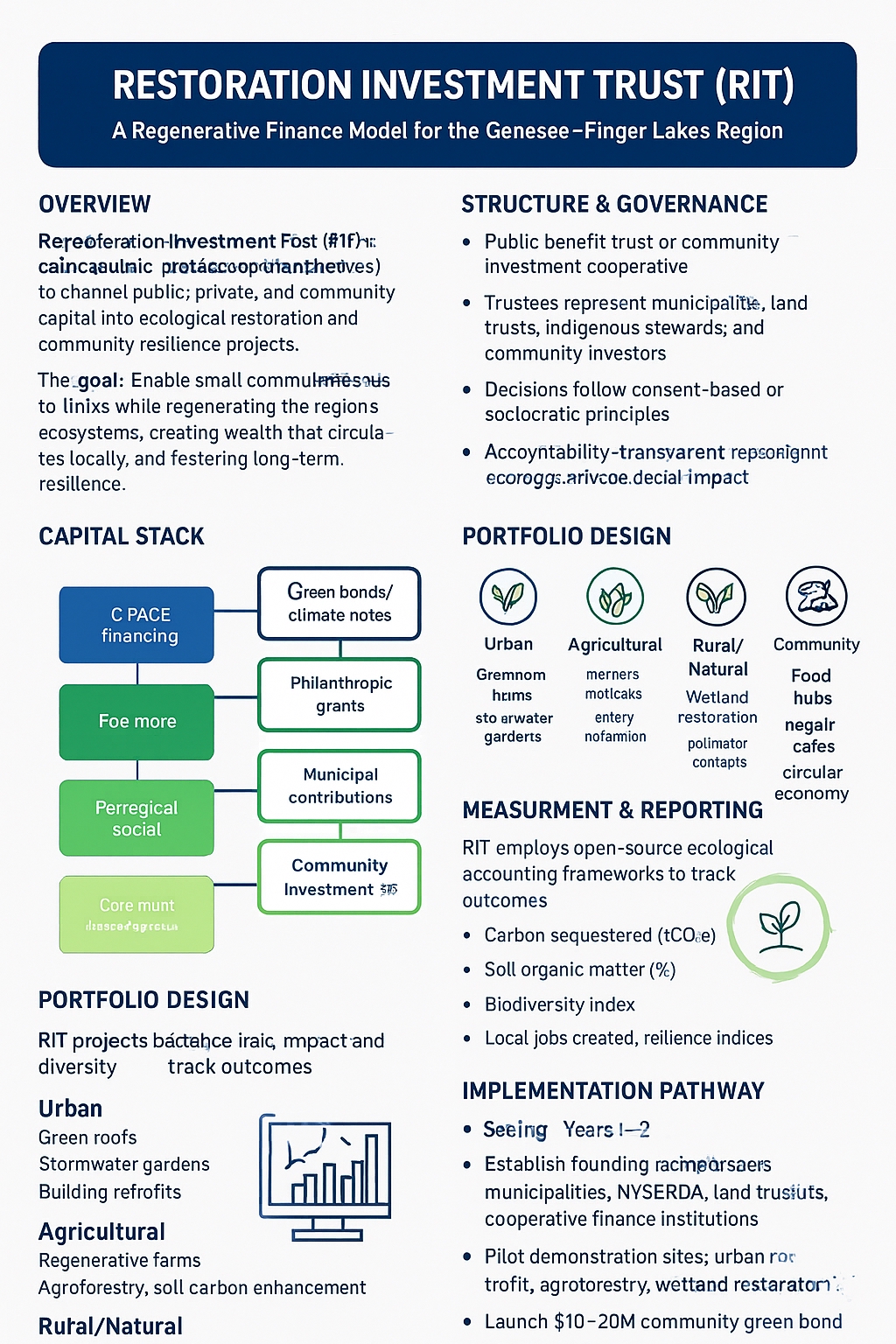

Overview

The Restoration Investment Trust (RIT) is a blended-finance vehicle designed to channel public, private, and community capital into ecological restoration and community resilience projects. RIT treats natural systems—forests, wetlands, soils, and watersheds—as productive assets, generating measurable ecological, social, and financial returns.

Goal: Enable small communities to thrive while regenerating the region’s ecosystems, creating wealth that circulates locally, and fostering long-term resilience.

Structure & Governance

- Legal Form: Public benefit trust or community investment cooperative.

- Governance: Trustees represent municipalities, land trusts, Indigenous stewards, cooperatives, and community investors. Decisions follow consent-based or sociocratic principles.

- Accountability: Transparent reporting of both financial flows and ecological impact using open dashboards.

Capital Stack

RIT combines multiple funding sources to finance projects:

| Source | Use |

|---|---|

| C-PACE financing | Commercial/multifamily retrofits for energy, water, resilience |

| Green bonds / climate notes | Wetland restoration, reforestation, agroforestry |

| Philanthropic grants | Early-stage risk mitigation |

| Municipal contributions | Land, matching funds, revolving loans |

| Community investment shares | Local ownership, democratic participation |

Returns:

- Financial: Modest dividends from ecosystem service payments, energy revenue, and property value uplift.

- Ecological/Social: Gains in biodiversity, soil carbon, water retention, local employment, and resilience capacity.

Portfolio Design

RIT’s projects balance risk, impact, and diversity:

- Urban: Green roofs, stormwater gardens, building retrofits.

- Agricultural: Regenerative farms, agroforestry, soil carbon enhancement.

- Rural/Natural: Wetland restoration, reforestation, pollinator corridors.

- Community: Food hubs, repair cafés, circular economy initiatives.

Each project contributes to a bioregional balance sheet of ecological health and social wellbeing.

Measurement & Reporting

RIT uses open-source ecological accounting frameworks to track outcomes:

- Carbon sequestered (tCO₂e)

- Soil organic matter (%)

- Biodiversity index

- Local jobs created

- Energy savings & resilience indices

- Community ownership ratio

Dashboard: Accessible online, providing full transparency to investors and community stakeholders.

Regenerative Feedback Loop

Profits are reinvested into:

- Early-stage restoration projects

- Education & workforce training

- Technical assistance for local enterprises

This creates a self-perpetuating regional endowment for ecological and social resilience.

Implementation Pathway

Phase 1: Seeding (Years 1–2)

- Establish founding partners: municipalities, NYSERDA, land trusts, cooperative finance institutions.

- Pilot demonstration sites: urban retrofit, agroforestry, wetland restoration.

- Launch $10–20M community green bond.

Phase 2: Scaling (Years 3–5)

- Diversify project pipeline aligned with C-PACE and local priorities.

- Open portal for small-investor participation.

- Begin ecological dividend distributions.

Phase 3: Replication (Year 5+)

- Share the model with neighboring bioregions.

- Adapt to local ecological and economic contexts.

Key Benefits

- Ecological: Accelerates carbon sequestration, habitat restoration, water quality improvement.

- Economic: Creates local jobs, retains wealth regionally, leverages multiple financing streams.

- Social: Strengthens community engagement, equity, and capacity for collaborative governance.

- Scalable: Model can be replicated across bioregions with adaptation to local context.

Contact / Further Information

Center for Regenerative Community Solutions (CRCS)

Email: info@crcs.org | Web: www.crcs.org

If you want, I can also create a version with visual elements — flow diagrams for the capital stack, portfolio map, and regenerative feedback loop — that would make this look like a professional two-page handout suitable for funders or municipal briefings. This would complement the text and make it more persuasive.

Do you want me to do that next?

Yes